In this episode of The Cash News, we have another exclusive recording from the Banknote & Currency Conference, hosted by Currency Research, of a presentation from Alex Bau, vice president of data and policy analysis at the Federal Reserve Cash Product Office. His team researches how cash is being used in the United States, how cash usage evolves over time, and how the cash supply chain shifts to meet those changes. In his presentation, Bau shares an overview of cash trends in the U.S. and recent data from the 2021 Diary of Consumer Payment Choice.

The Fed observed a 10 percent increase year-over-year in U.S. currency in circulation, up to $2.18 trillion worldwide as of June 2021. Data shows an increase in larger denominations ($20, $50, and $100 bills), which suggests that consumers are using cash as a store of value instead of just a method of payment.

The amount of cash stored in cash vaults at banks and other financial institutions is at $85 billion as of June 2021, which is $11 billion below vault cash holdings in June 2020 but $21 billion above pre-pandemic levels in March 2020. Part of this is due to the economic stimulus payments in the United States, as banks wanted to prepare for a greater demand for cash from consumers who cashed checks or withdrew direct deposits in cash.

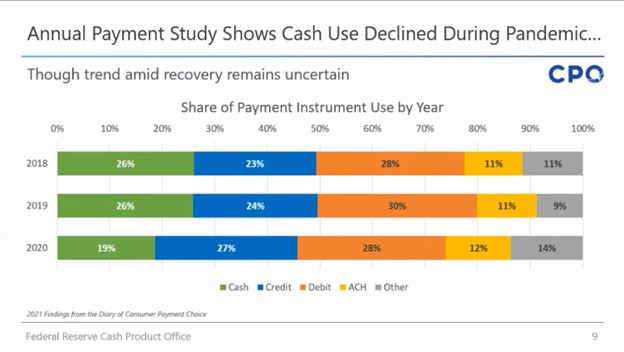

Data from the 2021 Diary of Consumer Payment Choice shows that cash use declined to 19 percent in 2020, compared to 26 percent in 2019, during the pandemic as payment preference for cards increased. However, consumer payment preferences are “sticky,” meaning that if a consumer wants to transition from using only cash to using credit cards, it will take a while for them to fully convert to credit card transactions only. Therefore, we can expect to still see many cash transactions, even as consumers shift toward card payments.

Although cash usage decreased, there was little impact on average total cash spending. This could be caused by two factors: fewer small-value payments or more consolidated shopping habits. The study found that on average, consumers reported about five fewer transactions per month than they did before 2020. Simply put, consumers just don’t shop the same way anymore. Instead of going to three or four stores at a time, they condense their shopping into just one or two stores, often spending the same amount of money either way.

Decreased cash usage can also be attributed to fewer in-person transactions, as online spending increased at traditionally in-person merchants such as general merchandise and department stores, grocery and convenience stores, and sit-down restaurants and bars. The increase in online shopping was already slowly happening prior to 2020, but social distancing and store closures during the coronavirus pandemic pushed consumers to turn toward not-in-person payments at much faster rates than we would have seen otherwise.

In-person payments overall remain below pre-pandemic levels, although they have recovered since the early days of the pandemic in April 2020. This has also likely reduced cash use and contributed to the coin circulation challenge, with coin circulating at levels well below what we saw before the pandemic.

—

Currency Research has a ton of exciting events about cash and currency in the coming months:

- The EMEA Cash Cycle Seminar: Amsterdam, November 1–3, 2021

- The Americas Cash Cycle Seminar: San Diego, December 6–9, 2021

- The Banknote & Currency Conference: Washington, DC, February 21–24, 2022

- The Digital Currency Conference: Washington, DC, February 25, 2022